The Post Office RD Scheme (Recurring Deposit Scheme) is one of India’s most trusted saving options for people who want to build money slowly and safely. Backed by the Government of India, this scheme is ideal for salaried individuals, homemakers, students, and anyone who prefers disciplined monthly savings with guaranteed returns.

What Is the Post Office RD Scheme?

The Post Office Recurring Deposit Scheme allows you to deposit a fixed amount every month for a fixed tenure. It encourages regular saving habits and offers assured interest, making it a low-risk investment option. Since it is run by India Post, your money remains completely safe.

Who Can Open a Post Office RD Account?

Any Indian citizen can open a Post Office RD account. Even minors can have an account opened in their name through a guardian. Joint accounts are also allowed, which makes it suitable for families planning savings together. Only one RD account per person is allowed in one post office branch.

Investment Amount and Tenure

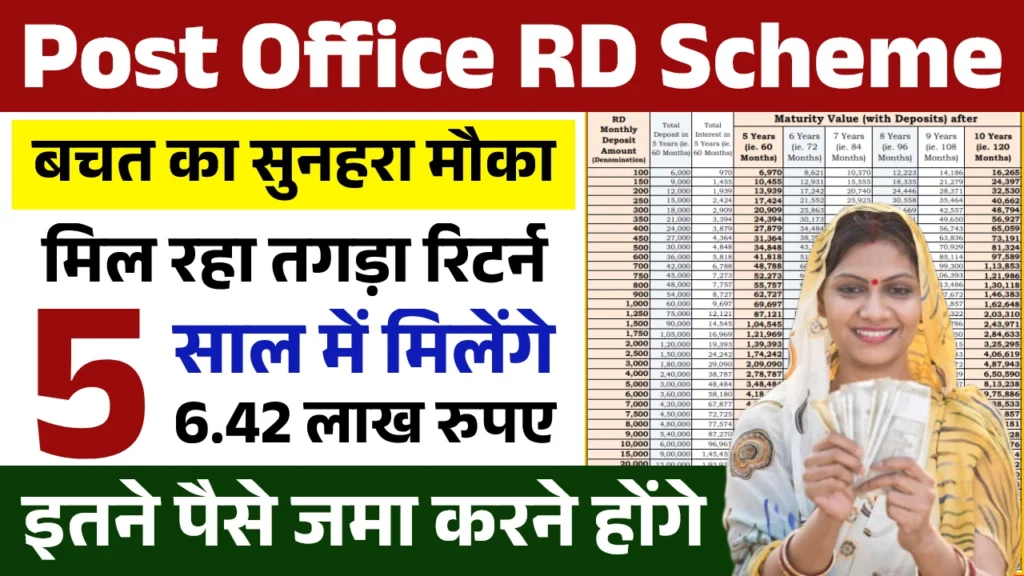

The minimum monthly deposit in the Post Office RD scheme starts from a small amount, making it affordable for everyone. Deposits are made every month for 5 years (60 months). You can choose your monthly contribution based on your income and saving goals, and the maturity amount depends on how much you invest each month.

Interest Rate and Returns

The Post Office RD scheme offers a fixed interest rate that is revised by the government from time to time. Interest is compounded quarterly, which helps your savings grow steadily over the years. Because returns are guaranteed, it is a preferred option for conservative investors who want stable growth without market risk.

Premature Withdrawal and Loan Facility

After completing a certain period, account holders can avail a loan against their RD balance. Premature withdrawal is also allowed after a specific time, though some conditions apply. This flexibility makes the scheme useful during financial emergencies while still promoting long-term saving.

Why Choose the Post Office RD Scheme?

This scheme is perfect for people who want disciplined savings, guaranteed returns, and zero risk. It is easy to open, simple to manage, and ideal for meeting future needs like education, marriage, or emergency funds. The government backing adds an extra layer of trust and security.

Maturity Amount and Payout

At the end of the 5-year tenure, the total deposited amount along with interest is paid to the account holder. The maturity amount depends on the monthly deposit and prevailing interest rate, making it a predictable and reliable saving option.